China’s central statistics bureau delivered the bad news on Oct. 21: Gross domestic product had risen at only a 7.3 percent annual rate in the most recent quarter, the slowest rate of expansion since the depths of the financial crisis. The report confirmed the country was on pace for its most sluggish annual growth in almost a quarter century.

To any investors who took the gloomy data as a signal to sell their Chinese stocks: deepest condolences. Alarmed by the weak numbers, China’s central bank surprised markets around the globe a month later, cutting its benchmark one-year lending and deposit rates for the first time in two years, a shift that encourages corporations to borrow and expand. That has sent the Shanghai Composite Index soaring—returning 20 percent since Nov. 20, the second-highest performance of the 93 global equity gauges tracked by Bloomberg. After a 5 percent pullback on Dec. 9 and a 3 percent bounce the following day, the index is up 39 percent this year.

To any investors who took the gloomy data as a signal to sell their Chinese stocks: deepest condolences. Alarmed by the weak numbers, China’s central bank surprised markets around the globe a month later, cutting its benchmark one-year lending and deposit rates for the first time in two years, a shift that encourages corporations to borrow and expand. That has sent the Shanghai Composite Index soaring—returning 20 percent since Nov. 20, the second-highest performance of the 93 global equity gauges tracked by Bloomberg. After a 5 percent pullback on Dec. 9 and a 3 percent bounce the following day, the index is up 39 percent this year.

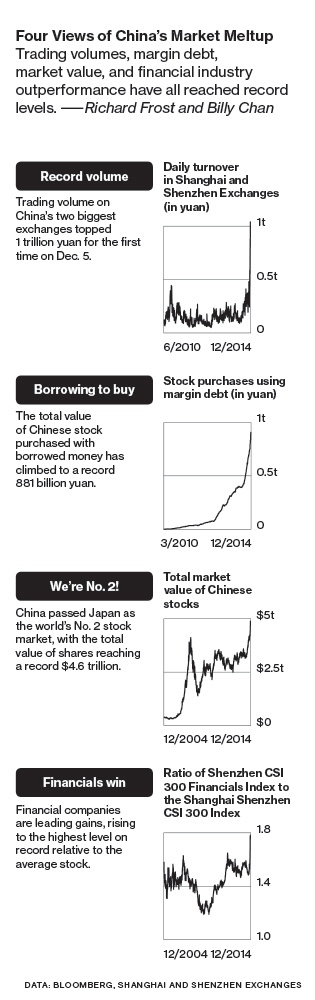

In Shanghai, 18 stocks have gains of greater than 50 percent since the rate cut, led by Sinotex Investment & Development (600061:CH), a textile manufacturer, and Dawning Information Industry (603019:CH), which makes supercomputers. Financial companies are the hottest industry group, up 52 percent.

A Stock Connect exchange link between Hong Kong and Shanghai that opened on Nov. 17 has helped prime the rally; it allows residents of mainland China to buy Hong Kong shares for the first time and gives foreign investors access to Shanghai listings. Plummeting global prices for oil and iron ore have also boosted expectations for corporate profit. More than 100 Chinese initial public offerings this year have added to the frenzy.

Companies with dual listings in Shanghai and Hong Kong have long seen identical shares trade at different prices, a reflection of trading restrictions and market inefficiencies. The gaps were expected to go away once the equity link opened last month; the reverse has happened. With the roaring Shanghai market riveting the investing world’s attention, dual-listed stocks are now 16 percent cheaper in Hong Kong, the biggest gap in more than two years.

“China’s stock rally in the last two weeks can’t be explained by any economic fundamentals,” Ken Peng, a strategist at Citigroup’s (C) private bank in Hong Kong, said on Dec. 5, as daily trading volume passed 1 trillion yuan ($162 billion) for the first time. “If the central bank shifted course in easing, China’s stock market rally would fizzle away very quickly.”

The China rally follows a pattern of equity markets spiking in response to central bank moves. Japan redoubled its bond buying program on Oct. 31 as its economy officially entered a recession, sending its benchmark Nikkei index to the highest level since 2007. In the U.S., the Standard & Poor’s 500-stock index gained 40 percent during the Federal Reserve’s latest round of stimulus.

The Shanghai Composite has crashed before, falling 72 percent from its all-time high in October 2007 through the following November, and despite this month’s surge it stands at half its peak.

Source: Bloomberg