The Commercial Bank of Africa’s (CBA) Uganda subsidiary has applied for a licence to launch an M-Shwari equivalent in the neighbouring country, seeking to replicate the success that the mobile banking service has recorded in Kenya.

Uganda has written to the Bank of Uganda (BoU) seeking the green light to launch a savings and loans mobile service by April in collaboration with MTN, one of the country’s leading telecommunications operators.

CBA Group in May 2014 launched a similar product (M-Pawa) in Tanzania in partnership with Vodacom, meaning that the Uganda launch will see the model replicated in all three countries where the lender has a presence.

“We are seeking approval of the central bank before we can launch the product by the end of the first quarter of 2016,” said Samuel Odeke, the CBA Uganda chief executive, in an interview with Ugandan publication Daily Monitor.

We are working with the mobile operator, MTN, to test the product that will help develop the culture of savings and access to financial services. There are various regulatory requirements we have to meet as prescribed by BoU.”

CBA Uganda started operations in April 2014, but held the official launch ceremony in Kampala on Monday where Mr Odeke disclosed the partnership plan.

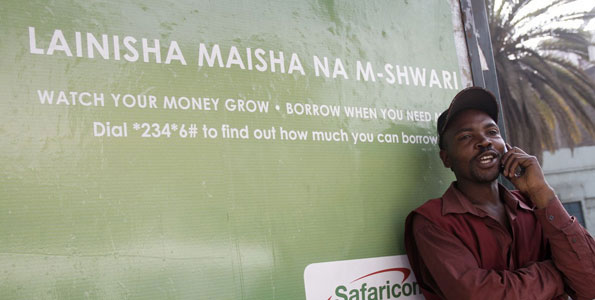

Launched in November 2012, in partnership with Safaricom, M-Shwari has strengthened CBA’s position in retail banking with its customer base currently at 13 million.

M-Shwari’s deposits as of March 2015 stood at over Sh153 billion, placing it in the category of large banks while its loan book was at the time in excess of Sh29 billion.

The bank processes an average of 70,000 M-Shwari loans daily.

“The product is already in Tanzania and, in line with our strategy of extending the Kenyan model to all our subsidiaries, we have sought approval to launch it in Uganda,” Chris Pasha, CBA Group’s head of marketing said in an interview.

“(The product) is relevant to the Ugandan market, which only has 15 per cent penetration of formal financial services,” he said, adding that the country has one of the fastest growing mobile money markets in Africa.

CBA specialises in banking mainly corporate and high-end clients. The introduction of M-Shwari has helped it “serve a wider population through partnering with mobile operators.”

Vodacom, a subsidiary of Safaricom’s parent company Vodafone, partnered with CBA Tanzania to launch M-Pawa in Tanzania mid-2014.

Customers, who are required to have an active M-Pesa account, are offered month-long loans at a one-time interest of nine per cent while deposits earn an interest of five per cent.

Source: Business Daily