European stocks rallied, trimming their worst January drop since 2008, after the Bank of Japan’s added stimulus stoked optimism of policy support for global growth.

The Stoxx Europe 600 Index rose 2.2 percent at the close, after the BOJ announced a negative interest rate. In the U.S., a report showed slower economic growth last quarter, after Federal Reserve officials said this week they’ll watch how global financial developments affect the American outlook.

“We were not expecting such a bold move from BOJ so the market is cheering their decision,” said Stephane Ekolo, chief European strategist at Market Securities in London. “As the BOJ has done its move, now the ECB will follow suit. When we look at all the negative news we’ve had lately, this is a bit of sunshine in the cloudy picture.”

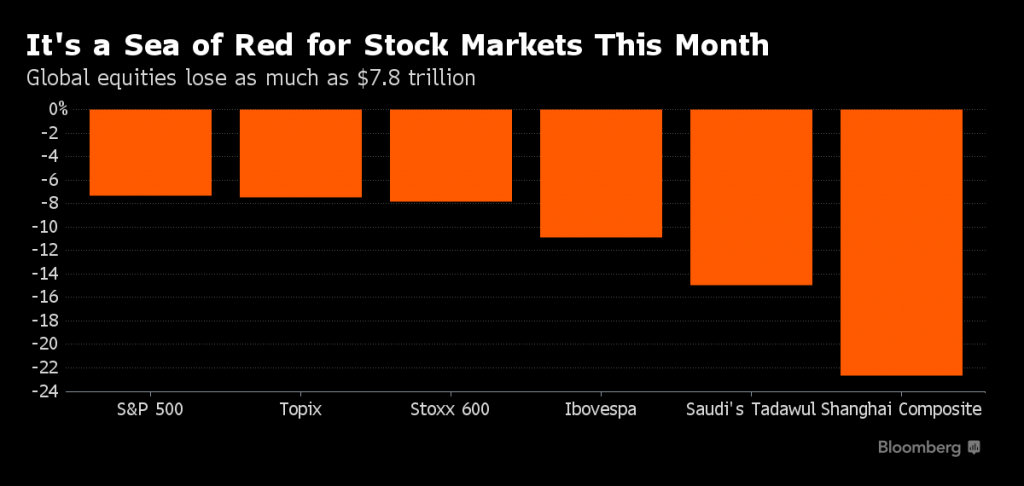

Equities have had a wild ride this year as China’s slowdown and an oil rout spurred anxiety about the global economy. After reaching a 15-month low last week, the Stoxx 600 got a boost from Mario Draghi’s comments that the European Central Bank may reconsider its policy stance in March. The benchmark has gained 1.2 percent this week, trimming its January losses to 6.4 percent.

European stocks rallied, trimming their worst January drop since 2008, after the Bank of Japan’s added stimulus stoked optimism of policy support for global growth.

The Stoxx Europe 600 Index rose 2.2 percent at the close, after the BOJ announced a negative interest rate. In the U.S., a report showed slower economic growth last quarter, after Federal Reserve officials said this week they’ll watch how global financial developments affect the American outlook.

“We were not expecting such a bold move from BOJ so the market is cheering their decision,” said Stephane Ekolo, chief European strategist at Market Securities in London. “As the BOJ has done its move, now the ECB will follow suit. When we look at all the negative news we’ve had lately, this is a bit of sunshine in the cloudy picture.”

Equities have had a wild ride this year as China’s slowdown and an oil rout spurred anxiety about the global economy. After reaching a 15-month low last week, the Stoxx 600 got a boost from Mario Draghi’s comments that the European Central Bank may reconsider its policy stance in March. The benchmark has gained 1.2 percent this week, trimming its January losses to 6.4 percent.

Lenders in Italy and Spain were among the best Stoxx 600 performers, pushing their national benchmarks to some of the biggest gains in Europe. Banco Popular Espanol SA rallied 7 percent after its quarterly net interest income improved, while Banco de Sabadell SA jumped 12 percent on better-than-estimated earnings. Banco Popolare SC and Banca Popolare di Milano Scarl, said to be in merger talks, gained 7.4 percent or more. The IBEX 35 Index and the FTSE MIB Index rose 2.6 percent.

Among other stocks moving on corporate news, Gamesa Corp Tecnologica SA surged 19 percent after a report that Siemens AG is exploring an acquisition of the company. Telefonica SA advanced 3.6 percent after saying it will offer employees early retirement in a plan that will save money in the long term.

ThyssenKrupp AG slid 3.2 percent after its chief executive officer said he sees “major risks” for Europe’s steel industry. ArcelorMittal and Voestalpine AG declined more than 2.4 percent, dragging the region’s commodity producers lower.

All Stoxx 600 industry groups declined in January, with banks, miners and auto stocks leading losses. Among national benchmarks, Italy’s FTSE MIB was the worst performer, down 13 percent. Germany’s DAX Index, heavily weighted by exporters, dropped 8.8 percent for its largest monthly drop since August.

Source:Bloomberg/Namitha Jagadeesh/Roxana Zega