When you find yourself in a hole, the saying goes, stop digging. A simple lesson that arguably has bypassed a mining industry that’s wiped out more than $1.4 trillion of shareholder value by digging too many holes around the globe.

The industry’s 73 percent plunge from a 2011 peak is far beyond the oil industry’s 49 percent loss during the same time.

Just how long it will take for the world to erode bulging stockpiles of metals, coal and iron ore was the central debate at the mining industry’s biggest investment conference in Cape Town this week, which attracted more than 6,000 top executives, bankers, brokers, analysts, miners and reporters. Here’s what they concluded.

The Worst Is Yet to Come

This year may be the worst yet with prices trending lower for longer, according to Anglo American Chief Executive Officer Mark Cutifani, who says his company should be better prepared “for the winter that inevitably comes after the summer.”

The Australian revealed that since he took on the role 33 months ago the company’s revenue had slumped by an average of $350 million a month.

Distress or Impress

The industry is splitting into two classes of citizens: those under distress and those that will impress by riding out the downturn and coming out on the other side in a stronger position heading into the next cycle.

Vedanta Resources CEO Tom Albanese was hesitant to call the bottom. Vedanta, like its peers, is focused on paying its debts and will be “hunkering down and getting that done,” he said in an interview with Bloomberg Television.

“Those businesses that are best at it will be best-recovering,” said Albanese, the former boss of Rio Tinto.

Sticky Supply

Gluts of everything from iron ore to copper are the main challenge for the industry. China’s slowest economic growth in a generation has led to oversupplies of metals, and for that, the industry is largely to blame, Cutifani said. The big cost of environmental cleanups after closing a mine is preventing closures and prolonging the downturn.

“Excess supply is awash in most commodities and as painful as it is, economically and rationally it needs to leave the market to create a long term sustainable future,” said Graham Kerr, CEO of South32 Ltd., the spin-off of BHP Billiton.

Gold, a Shining Light

Gold, this year’s best performing commodity, is giving miners some hope. Its safe-haven status makes it immune to many of the forces that have weighed on industrial metals and bulk commodities.

“The test is going to be now with this pick-up in the gold price and the absolute confusion around the global economy, and watching everyone suddenly rush back to gold and gold equities,” said Mark Bristow, CEO of Randgold Resources, whose shares have surged 40 percent this year.

Prices are strong and companies are looking to acquire, said Neil Froneman, the CEO of Sibanye Gold, South Africa’s biggest gold producer.

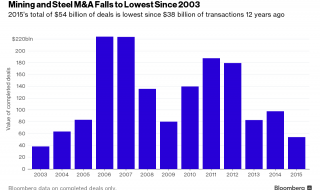

Deals Will Happen

The time for mergers and acquisitions in gold is ripe, according to Sibanye.

“This doesn’t come around very often, maybe every 15, 20 years,” Froneman said.

The biggest producers have been battered by the slump in commodity prices that’s forced producers to dispose of lower-quality mines and smelters. Anglo American, which is selling half of its assets, will probably announce sales of its coal assets in the country in the next two weeks, according to the South African Mineral Resources Minister.

Private equity groups are circling. The value of private-equity deals in the mining industry will rise this year from $3.2 billion in 2015 as top producers save money and offload unwanted operations, according to U.K. law firm Berwin Leighton Paisner.

A Flood of Shares

BlackRock’s Evy Hambro, one of the most prominent mining investors, was blunt in his assessment of the industry. When asked about the outlook for supply, he quipped the most abundant commodity would be new shares in mining companies. He expects the “floodgates to open” on share sales as the industry raises cash to rebuild battered balance sheets.

Source: Bloomberg